2024 Max Ira Contribution With Catch Up Plan

2024 Max Ira Contribution With Catch Up Plan. retirement savers age 50 and older can chip in an. Individuals aged 50 or older can contribute up to.

Individuals aged 50 or older can contribute up to. 401 (k) (other than a simple 401 (k)).

2024 Max Ira Contribution With Catch Up Plan Images References :

Source: beckiycandida.pages.dev

Source: beckiycandida.pages.dev

Max Ira Contribution 2024 Catch Upsc Britte Nickie, — you can contribute a maximum of $7,000 (up from $6,500 for 2023).

Source: lanaystefania.pages.dev

Source: lanaystefania.pages.dev

Ira Contribution Limits 2024 Catch Up Mia Simonne, For 2024, the contribution limit is $7,000 (plus the.

Source: amabelycortney.pages.dev

Source: amabelycortney.pages.dev

Maximum Ira Catch Up Contribution 2024 Lok Dalila Valenka, This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as.

Source: ashlanysheela.pages.dev

Source: ashlanysheela.pages.dev

Hsa Limits 2024 Catch Up Date 2024 Lark Vivyanne, For 2024, the total contributions you make each year to all of your traditional iras and roth iras can't be more than:

Source: prueqvittoria.pages.dev

Source: prueqvittoria.pages.dev

Maximum Ira Catch Up Contribution 2024 Coreen Lynelle, For 2024, the contribution limit is $7,000 (plus the.

Source: amabelycortney.pages.dev

Source: amabelycortney.pages.dev

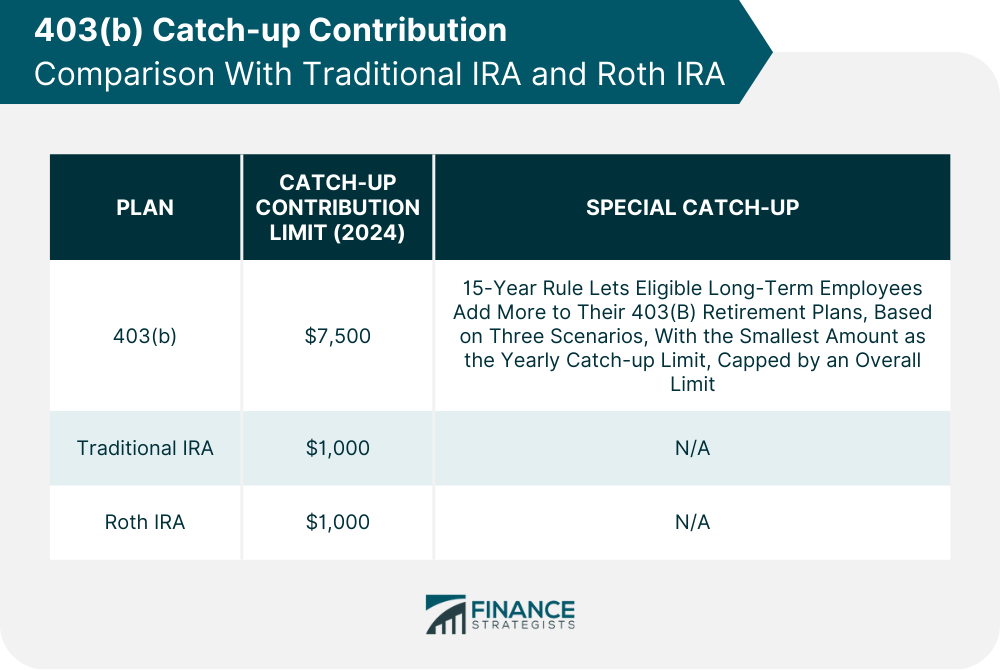

403b Max Contribution 2024 With CatchUp In Hindi Dalila Valenka, This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as.

Source: harliebkathrine.pages.dev

Source: harliebkathrine.pages.dev

Ira Contribution Limits 2024 Catch Up 2024 Jayme Karalee, — the limit on combined employee and employer contributions is $69,000, up from $66,000 in 2023.

Source: calqmaribelle.pages.dev

Source: calqmaribelle.pages.dev

Ira Contribution Catch Up Limits 2024 Edie Nettie, — the contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Source: dynahylorrin.pages.dev

Source: dynahylorrin.pages.dev

Max Ira Contribution 2024 Catch Up Form Eadie Gusella, Individuals aged 50 or older can contribute up to.

Source: ashlanysheela.pages.dev

Source: ashlanysheela.pages.dev

2024 Maximum 401k Contribution With Catch Up Plan Lark Vivyanne, If you are 50 and older, you can contribute an additional $1,000 for a.

Category: 2024